Panic! At the Fed

During the spring of 2023 the Federal Reserve faced the largest single day bank run in U.S. history. In just 24hrs $42 billion exited Silicon Valley Bank (SVB) with another $100B set to leave the next day. Here's a quick timeline of events:

March 8, 2023 - SVB announced $1.8B loss on their bond portfolio and plans to raise $2.25B by selling stock.

March 9, 2023 - $42B of depositor cash is transferred out electronically and SVB's stock crashes.

March 10, 2023 - $100B is queued up to leave and trading on the bank's stock is halted shutting it all down.

March 12, 2023 - Signature Bank (SBNY) fails.

March 19, 2023 - Credit Suisse fails. A 167-year-old bank in Switzerland.

May 1, 2023 - Republic Bank (FRB) fails.

That other failure that's hardly remembered is Credit Suisse. The 167-year-old, 2nd largest bank in Switzerland also failed! UBS bought them in a killer $3 billion dollar deal to bail out all the depositors' money. This deal will be kept secret by the Swiss parliamentary investigation for 50 years. Yes, that's right no one gets to know the details of the takeover for 50 years. Transparency baby. LOL. Imagine if an audit of a 167 yr old Swiss bank ever happened. The shit that'd come out! 😲

So why did the Fed Panic!

On March 12, 2023, the Fed, U.S. Treasury and FDIC all announced they would be covering ALL deposits at Silicon Valley Bank. Not just the FDIC insured $250k per account. At first glance, it looked like the Fed was bailing out the rich again from their monumental blunder at Y-Combinator, the favorite start-up incubator in Silicon Valley, who had all their investor funds at SVB as uninsured deposits. However, the real reason was not to bail out the rich, but instead to stop a contagion from reaching JPMorgan. You see while SVB had $150B in uninsured deposits, JPMorgan has $1.058 trillion in uninsured deposits! If the bank run were to spread to JPMorgan, we'd be looking at an extinction level event of the entire Western Financial System.

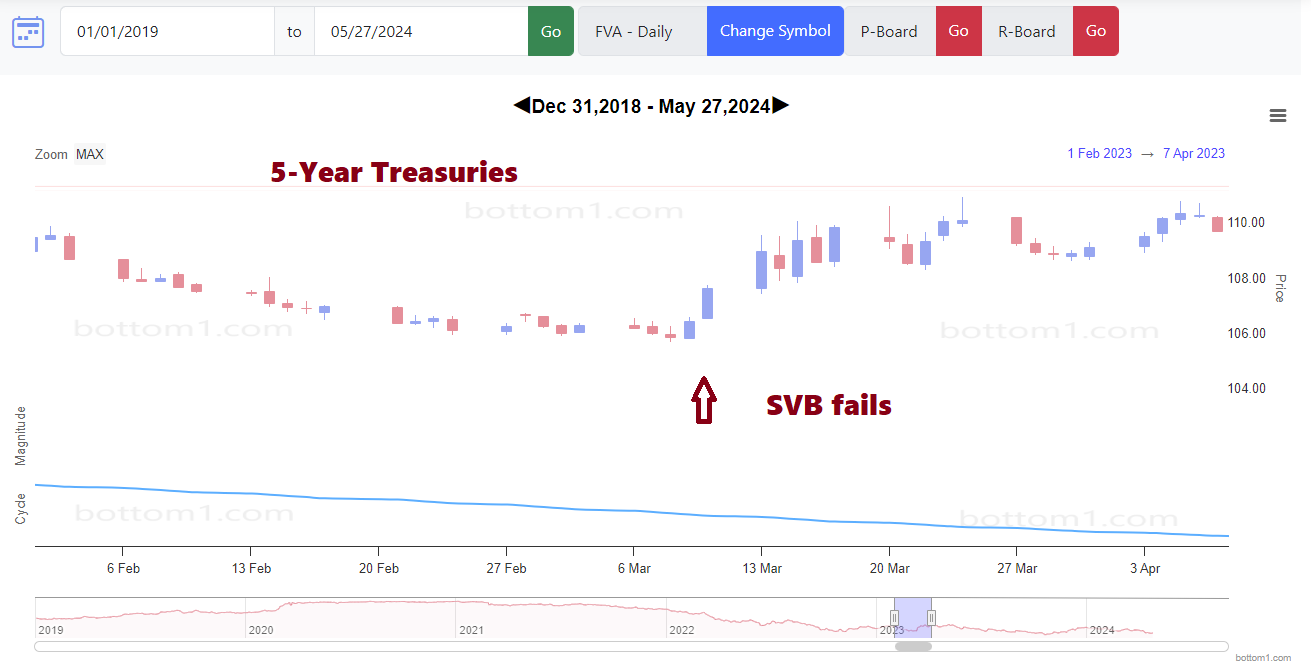

ZERO 👻Ghost Patterns on 2-Year, 5-Year, 10-Year and 30-Year Treasury Futures!

Wait what? Not even 1? Yup, not even 1. I'm finding ghost patterns in treasuries all across the board before big events like I find in stocks. But absolutely nothing during this event. It took me several hours of contemplating what this could mean. I came to a very simple realization. Because of the magnitude and scale of the crisis, the Federal Reserve went into overdrive buying everything they could get their hands on in the Treasuries market in order to force all money into Risk Assets (the stock market). THAT'S why there's not a single ghost pattern triggered during the 2nd, 3rd, and 4th largest bank failures in U.S. history. All the big money when into the stock market. No one bothered to trade Notes and Bonds. Plus, the Fed wouldn't trigger a ghost pattern because they buy all their Treasuries Over The Counter (OTC) through their Primary Dealers which aren't reported like Stocks and Futures trades.

So there you have it. If you're a member here at bottom1.com, and a major banking crisis hits and you don't see any ghost patterns forming on my Treasury charts, you know what to do. 😎

Here's my charts just for reference:

Zero 👻 Ghost Patters.

👇

Image Source: Panic! At the Disco

A fun band you can listen to here on Spotify 🤘