Yakov Rogoff

On May 31st I witnessed a massive ghost pattern on the Nasdaq Futures (NQ) intraday chart which occurred during the cash open (9:30am opening bell). First off, large ghost patterns which run for several hours are important. Ghost patterns that run for several hours and have a high magnitude are even more important. Ghost patterns which run for several hours, have a high magnitude, and overlap the first 1 - 2 hours of the opening bell are astronomically important!

Before we get into it, I understand this idea of a ghost pattern might be foreign to most everyone. However, it's a real phenomenon in the stock market. It's basically anomalies in the market data feeds. This is what I've found, an anomaly in the data. After I invented a completely new stock market indicator to help in my trading, I found the ghost pattern buried deep within it. To prove my point further that "ghost patterns" in the stock market exist, here's a quote from D.E. Shaw, who famously discovered a ghost pattern back in the 1980's. Yes, the same D.E. Shaw who currently manages $60Billion in assets and who Jeff Bezos worked for before he founded Amazon 😲. Shaw said: "patterns [in the stock market] that are difficult or impossible to explain are more valuable because others are less likely to discover or exploit them."

May 31st, I saw 2hrs of non-stop panic selling on Nasdaq futures starting from retail open thru cash open. FYI, A👻during cash open is very powerful. This one went off the charts on magnitude. Panic selling! Then Biden Admin interfered. The near term Nasdaq top already happened. pic.twitter.com/KGd3n82dFu

— bottom1 (@Bottom1Frankdux) June 15, 2024

As I posted on June 15th, the ghost pattern I witnessed was huge. It had a magnitude of 711pts. The highest magnitude I have on record up until May 31st is ~500pts. This beat it by 200pts AND it occurred during the first hour of trading! Of course I went short immediately. As you can see in the chart below, I was deep in profits and expecting more, but then something strange happened. The market started going back up with new long bullish ghost patterns. The magnitudes weren't anywhere near the monster selloff pattern that ran in the morning. But still the market was moving up and with stacking ghost patterns (very powerful) To be honest I was pretty shocked and by 3:30pm I knew something was very wrong and decided to check the news. C-SPAN is my go to for .gov news. And there it was. President Biden had called a stop to the war in Gaza shortly the press conference started at 1:28pm. Of course a ghost pattern started 10min before he appeared on screen. If you notice on the chart the price stopped dead on the top of the ghost pattern price band from the morning. That's when I got stopped out for a loss. The full image from the post is below for convenience.

Now, before I found the Biden press conference, I was certain the Nasdaq would continue to fall for the rest of the day and into the next week. I was even planning an X post for the weekend calling the top of the Nasdaq. Instead, and since I got stopped out, I decided to wait and see how this played out. Sure enough, on Monday, more buy ghost patterns appeared above the giant sell pattern. That was a very strong indicator prices would hold. The recovery was now sealed. The Biden Administration's call to end the war in Gaza literally saved the Nasdaq.

Why am I writing about this 3 weeks after the fact? Because I just connected the dots and realized what had happened on May 31st.

So, May 31st was a Friday. The next week on Wednesday June 6, the European parliamentary elections started and lasted until Sunday June 9th. What was the outcome? The Macron regime in France suffered a massive political defeat. It was so bad that Macron himself announced the dissolution of the French parliament and called for snap elections to prevent the far right from gaining further power. This was the biggest political event since Russia invaded Ukraine in February 2022.

This was the reason the Nasdaq took an absolute dump on Friday morning during the cash open. PANIC SELLING! How could "they" have known you ask? Easy. There was probably polling that showed Macron was going to lose big the following week and would probably cause huge market turmoil. Certainly the big Wall Street banks were notified and probably colluded with the Biden Administration telling them that if Macron lost, billions would come out of the Markets. So, what did they Biden Administration do? They finally called a stop to the Gaza war. Something they could have done at any time they wanted! I of course have zero proof of any of this but if you've been reading my articles, you should know this is how it works. The powerful / elite / donors / oligarchs get the news before everyone else and take action. Without the ghost patterns going bananas on Friday May 31st we would not have understood the magnitude of what was about to happen and WHY the Biden Administration responded the way they did. The Biden Administration, which has been driving the collective Wests' decisions on Ukraine was about to be rebuked in a big way in France. The French government thru the Biden Administration has been forced to fund the war in Ukraine and the people of France have finally been able to speak about it. The people spoke through elections and rebuked their government's position on Ukraine and also their government's position on immigration. Here's where it gets interesting. Wars are inflationary. If the wars stop, especially the war in Ukraine, the stock markets will crash. Since there's no more monetary stimulus from the central banks because inflation is rampant, the only way to keep the house of cards going is to start a war. Russia was very obliging to us in that regard OR we ratcheted things up so far in Ukraine, Russia was forced to invade. Either way, that war stopped the US economy and the rest of the West from nosediving into recession due to nose bleed interest rates. US governments formula for getting us out of a recession: Start a War. Starting a war triggers money printing by .gov (fiscal stimulus). No war, no fiscal stimulus. And since interest rates are so high and the FED cannot print anymore (or we get $20 milk). The party will officially be over and a deflationary spiral will take hold here in the US and in Europe, followed by a recession.

Therefore, the wars must continue. If you paid close attention, did you notice that the war in Gaza started just as the funding for Ukraine was gridlocked for 6 months in Congress? Pretty amazing timing for the Hamas terrorists to attack Israel (a super power with nuclear weapons) don't you think? Or maybe not since we found out through Dave Smith's appearances on many online debates that the Netanyahu regime was secretly funding the Hamas regime to the tune of billions:

Zerohedge - Israel Palestine Debate with Dave Smith and Laura Loomer: https://www.youtube.com/watch?v=zt2WxIIurYM

Dave Smith on Piers Morgan again exposing the Netanyahu regime funding Hamas: https://www.youtube.com/watch?v=VwFmc6ouWQc

Did the Netanyahu regime let this happen to kickstart another war? I don't know y'all but it certainly looks suspicious.

So, the Biden administration needed great news to save the markets and they pulled it right out of their hat. Stop the genocide in Gaza. This is why I believe the top for the Nasdaq already happened on May 31st. The rest of the move higher is bag holding for what is to come...

What is to come you might ask? Let's ask Yakov Rogoff. Once I connected the dots for the "May 31st Nasdaq / Biden stop Gaza war / Macron losing bigly" event, I remembered this nugget in Ken Rogoff's famous 2017 book "The Curse of Cash." I've highlighted the important statement:

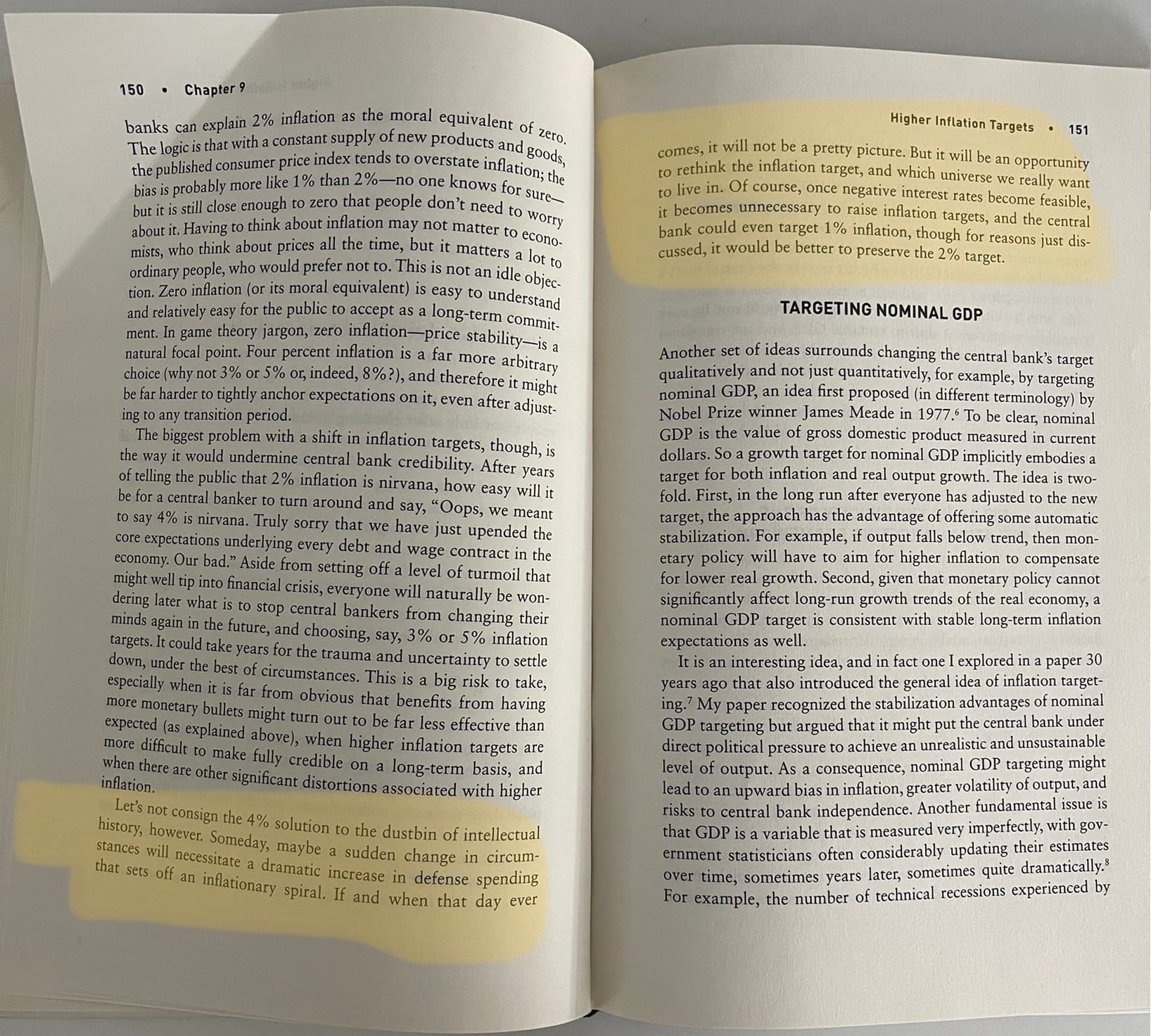

"Someday, maybe a sudden change in circumstances will necessitate a dramatic increase in defense spending that sets off an inflationary spiral. If and when that day ever comes, it will not be a pretty picture."

WHAT?! 🤯 You mean kind of like now??? If you read these 2 pages you'll see what he's talking about is top of mind at the FED right now. I'm guessing the weeks and months to come are going to be very interesting..

What have we learned hear at bottom1.com?

✌️ 👇👻

Ken Rogoff's book:

https://www.amazon.com/Curse-Cash-Large-Denomination-Constrain-Monetary/dp/0691178364